The digital gold rush continues, and at the heart of it all hum the mining farms, sprawling warehouses filled with the tireless workhorses of the blockchain: mining rigs. But navigating this landscape requires more than just hardware; it demands foresight, a keen understanding of market dynamics, and an awareness of the manufacturers driving the industry. One name that consistently echoes within mining circles is Canaan, a leading producer of ASIC miners. This article delves into the crucial factors influencing Canaan’s pricing trends, the broader cryptocurrency market analysis, and strategies for future-proofing your own mining farm in this volatile environment.

Bitcoin, the undisputed king of crypto, exerts a gravitational pull on the entire market. Its price fluctuations ripple outwards, affecting altcoins, mining profitability, and ultimately, the demand for mining hardware. Canaan, as a major supplier of Bitcoin miners, is inextricably linked to Bitcoin’s performance. When Bitcoin surges, the profitability of mining increases, leading to a surge in demand for Canaan’s miners and a subsequent increase in their prices. Conversely, a Bitcoin crash can trigger a sell-off in mining hardware, impacting Canaan’s revenue and potentially driving down prices. Understanding this symbiotic relationship is paramount for any mining farm operator.

Beyond Bitcoin, the rise of other proof-of-work cryptocurrencies like Ethereum Classic (ETC) and Dogecoin (DOGE) presents both opportunities and challenges. While Bitcoin mining remains dominated by ASICs, some altcoins are more accessible to GPU miners. This can create diversification options for mining farms, allowing them to hedge against Bitcoin’s volatility by mining a basket of cryptocurrencies. However, the profitability of altcoin mining is heavily dependent on factors like network difficulty and transaction fees, requiring constant monitoring and strategic adjustments. Furthermore, the potential shift of Ethereum to a proof-of-stake consensus mechanism has had significant ramifications for GPU mining farms, causing miners to seek alternative cryptocurrencies or sell their hardware.

Canaan’s product line is constantly evolving, with newer generations of miners boasting higher hash rates and improved energy efficiency. The introduction of these advanced machines often triggers a price adjustment in older models, creating a window of opportunity for savvy buyers. Keeping abreast of Canaan’s product roadmap and understanding the technical specifications of each miner is crucial for making informed purchasing decisions. Factors such as hash rate, power consumption, and chip technology all play a significant role in determining the overall profitability of a mining operation.

The global chip shortage, supply chain disruptions, and geopolitical factors all contribute to the unpredictable nature of the mining hardware market. These external forces can significantly impact Canaan’s production capacity and delivery timelines, leading to price fluctuations and potential delays. Mining farm operators need to factor in these uncertainties when planning their expansions and managing their inventory. Establishing strong relationships with reputable suppliers and diversifying sourcing options can help mitigate the risks associated with supply chain disruptions.

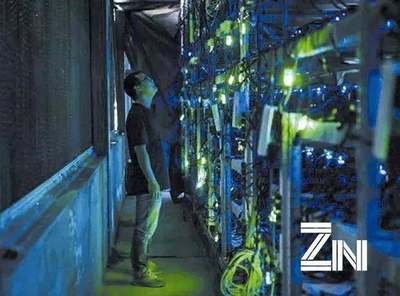

Hosting services provide an alternative for individuals or companies seeking to participate in cryptocurrency mining without the upfront investment and logistical challenges of setting up their own mining farm. These services typically offer a complete package, including hardware procurement, installation, maintenance, and security. Canaan’s miners are frequently found in hosting facilities around the world, providing a reliable and efficient mining solution. However, it is important to carefully evaluate hosting providers, considering factors such as their reputation, security measures, pricing structure, and geographic location.

Future-proofing your mining farm requires a multi-faceted approach. Firstly, diversification is key. By mining a portfolio of cryptocurrencies and exploring alternative mining opportunities, you can reduce your reliance on Bitcoin and mitigate the risks associated with market volatility. Secondly, investing in energy-efficient hardware and optimizing cooling systems can significantly reduce operating costs and improve profitability. Thirdly, staying informed about the latest technological advancements and market trends is crucial for making informed decisions and adapting to the ever-changing landscape of cryptocurrency mining. Finally, developing a robust risk management strategy that includes insurance coverage and contingency plans can help protect your investment from unforeseen events.

The journey of a mining farm operator is a constant balancing act, requiring a blend of technical expertise, market acumen, and strategic foresight. By closely monitoring Canaan’s pricing trends, analyzing the broader cryptocurrency market, and adopting a proactive approach to risk management, you can position your mining farm for long-term success in this dynamic and rewarding industry. Remember, the digital gold rush is far from over, and those who are prepared to adapt and innovate will be the ones who reap the greatest rewards.

Leave a Reply