In recent years, the allure of Bitcoin has captivated investors, tech enthusiasts, and entrepreneurs alike. But behind the shimmering surface of this premier cryptocurrency lies a complex machinery of mining—the pivotal process that not only secures the network but also generates fresh coins. As Bitcoin scales new heights in value, understanding the intricacies of mining profitability in the USA becomes paramount for potential miners and investors.

Bitcoin mining isn’t merely about possessing high-end technology; it requires an understanding of costs associated with running mining machines, energy consumption, and geographic location. The convergence of these elements determines whether a mining venture results in profit or loss. In the USA, with diverse electricity rates and climate conditions, miners must navigate several factors to effectively enhance their earnings.

The foundational element of mining profitability stems from transaction fees and block rewards. The Bitcoin network compensates miners who validate transactions with a reward that halves approximately every four years—a process known as halving. Currently, miners receive 6.25 BTC per block, an enticing figure on its own, but when considering operating expenses, that number can quickly dwindle. Energy costs, particularly, can eat into profits, especially in regions prone to high electricity rates.

It’s in this milieu that the strategic choice of location surfaces as a critically important factor. States like Texas and Washington draw miners due to their lower energy costs and favorable regulations. Such regions have witnessed a surge in mining farms as entrepreneurs set up operations designed to capitalize on the unique combinations of natural cooling and cheap power sources. Additionally, states are increasingly promoting blockchain technology, creating a smoother runway for miners.

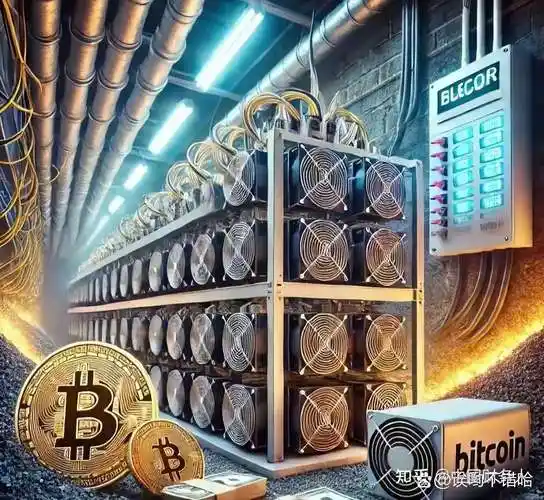

However, it’s not just geographic advantages that define success in Bitcoin mining. The equipment used—specifically, mining rigs and specialized GPUs—also plays a pivotal role in determining profitability. As the market evolves, so does the technology; efficient ASIC miners now dominate the landscape, demanding lower power intake while maximizing hash rate. Miners must remain vigilant in upgrading their rigs to optimize performance against the ever-growing difficulty level of mining new blocks.

One emerging trend is hosting services, enabling miners to lease space in managed facilities. This model presents a convenient solution for both seasoned and novice miners—eliminating overhead costs associated with building their infrastructures while still tapping into the robust mining capabilities. Moreover, hosting services typically provide enhanced security and optimal cooling conditions to safeguard expensive equipment from overheating or damage.

Amidst growing competition and a saturated market, it’s essential to compare alternative cryptocurrencies, such as Dogecoin (DOGE) and Ethereum (ETH). Each currency presents unique mining mechanisms and profitability metrics. Ethereum, for instance, plans a transition to proof of stake, shifting away from traditional mining practices, which could redefine its ecosystem and profitability. On the other hand, Dogecoin, despite its meme origins, continues to draw considerable mining action, providing an appealing entrée for new miners. The juxtaposition of these currencies against Bitcoin opens up intriguing scenarios for miners seeking diversified portfolios.

As with any investment, understanding market volatility plays a crucial role in gauging profitability. Exchanges are the pulse of the cryptocurrency market. They facilitate trades and allow miners to quickly convert mined coins into fiat currency or other digital assets. Knowing when to liquidate earnings versus holding for potential value increase bears significance in formulating a mining strategy.

In conclusion, while Bitcoin mining presents an enticing opportunity, it requires a critical understanding of various elements to maximize profitability. From choosing the right mining rig and hosting services to keeping an eye on market dynamics and exploring alternatives, striving for success in the Bitcoin mining arena necessitates both strategic foresight and adaptability. As the crypto space evolves, those miners who crack the code of profitability will emerge as front-runners, riding the waves of digital currency’s bright future.

Leave a Reply to BitZip Cancel reply